LETTER FROM LEADERSHIP

Dear partners and friends of CEDS Finance,

We are proud to present our FY24 Impact Report, showcasing the life-changing work of Community Enterprise Development Services (CEDS Finance) and the profound impact of your generous support from individuals, foundations, corporations, and governments.

We extend our heartfelt gratitude for your unwavering support of CEDS Finance and our mission to transform the dreams of underserved entrepreneurs into reality. Your dedication empowers us to uplift individuals and drive meaningful economic impact across Colorado’s diverse communities.

Since our inception in 2009, CEDS Finance has grown alongside nearly 600 small businesses, expanding our reach beyond Denver Metro to Morgan and Weld Counties and disbursing over $13.7 million in loans to entrepreneurs in need. In FY24, we proudly deployed $3,512,841 to 110 small business owners, the vast majority of whom come from BIPOC, low-income, immigrant, and refugee backgrounds. This financial support has been pivotal in weaving a richer, more diverse tapestry of businesses that embody the true spirit of our communities.

Since joining CEDS Finance in 2016, I (Alex) have witnessed first-hand the profound impact our organization has had on the lives of entrepreneurs and the communities we serve. The stories captured in this Annual Report represent the catalytic power of entrepreneurship and the essential ecosystem of support that every small business owner needs to thrive. These narratives showcase resilient entrepreneurs who, with your support, have overcome significant barriers to achieve their dreams.

We specialize in small-dollar, high-touch lending, ensuring that each borrower receives the personalized support they need to succeed. Our focus is on micro-entrepreneurs and startups—the smallest businesses that traditional lenders often overlook. By offering accessible, tailored financial support, we empower individuals to enter ownership and pursue their entrepreneurial dreams. This dedicated approach helps build sustainable businesses, fostering vibrant and resilient communities. Running a business is never easy, but these businesses are the heart and soul of our communities, and we are committed to helping them thrive.

CEDS Finance is scaling our impact through discipline and meaningful growth. In 2024, we took measured steps to fortify our foundation and build the framework for continued entrepreneurship and economic inclusion. We have expanded our board by welcoming diverse new members, upgraded our website to enhance the client marketplace, and improved our business and partner resources pages. Additionally, we have gained support from three new institutional donor relationships, further propelling our mission forward.

These strategic actions position us to expand our reach and deepen our support, ensuring that even more entrepreneurs can thrive. We are excited about what lies ahead and can’t wait for you to see what we have in store for 2025.

Thank you—our supporters and friends—for enabling us to continue supporting entrepreneurship and building stronger, better communities. Together, we are making the American dream of financial self-sufficiency a reality for many.

![]()

ALEXANDRIA E WISE

EXECUTIVE DIRECTOR

JONALYN DENLINGER

BOARD CHAIR

Table of Contents

ETHIOPIAN DAY & IRRECHA FESTIVAL

IRRECHA IS A THANKSGIVING FESTIVAL CELEBRATED BY THE OROMO PEOPLE OF ETHIOPIA

CEDS Finance proudly Sponsored the Somali Week Festival

ABOUT CEDS FINANCE

Founded in 2009, Community Enterprise Development Services (CEDS Finance) is a non-profit, mission-driven lender and Community Development Financial Institution (CDFI) that provides capital to underserved small business owners in Metro Denver and now in Morgan and Weld Counties. It helps small business owners realize their dreams by providing access to flexible capital and free business consulting. For many CEDS Finance’s clients, it is the first rung on the capital ladder.

OUR MISSION

CEDS Finance supports the American Dream of financial self-sufficiency by assisting refugees, immigrants, and those from underserved communities to start or grow their small business in Metro Denver and empower themselves financially.

WHAT SETS US APART

- Character based lending

- Flexible underwriting

- Collateral free loans (up to $50k)

- Accessible & inclusive financing

- Culturally responsive lending

FINANCIAL PRODUCTS

CEDS Finance offers three debt products, each customizable as either an interest-based small business loan or riba-free debt (Islamic-compliant murabaha).

SPARK

Up to $5k

- Credit builder loan

- No collateral or owner’s equity required

- Minimal documentation

- Fast underwriting and closing process

ELEVATE

Up to $50k

- Up to 10 year terms

- No collateral required

- No minimum credit score

- Owner’s equity required

AMPLIFY

Up to $100k

- Up to 10 year terms

- Collateral required

- Owner’s equity required

- No minimum credit score

business technical assistance (TA)

CEDS Finance provides hands-on support to help entrepreneurs strengthen their businesses and access the capital they need through:

Business Consulting Officer Kelly Nichols meets with ShellyAnn Allen, owner of African Caribbean Palate, to provide business coaching.

VIBRANT GROWTH

CEDS FINANCE’S FY24 IMPACT

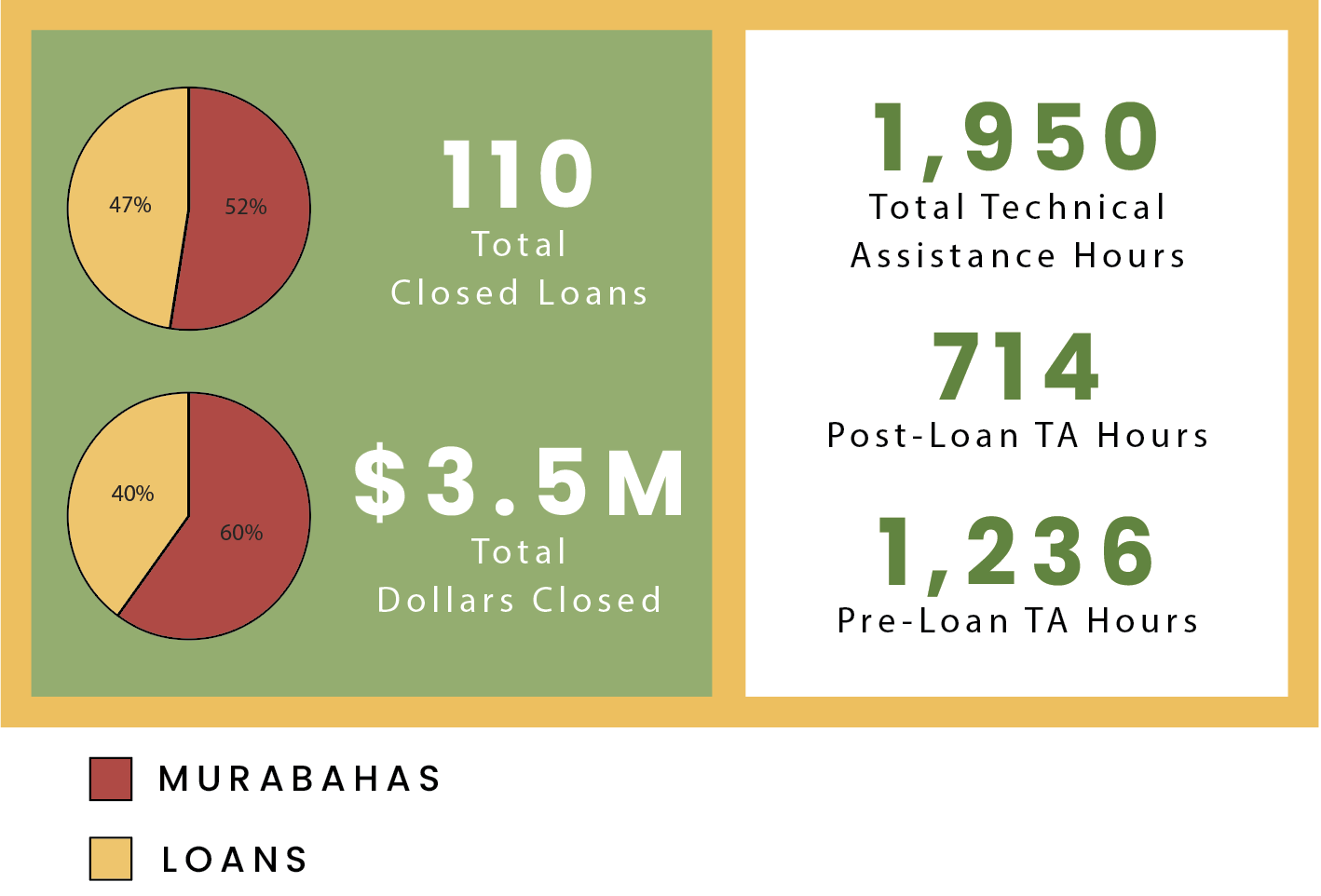

At CEDS Finance, we know that access to capital is more than just a loan—it’s a pathway to opportunity. As the first rung on the capital ladder, CEDS Finance provides flexible, accessible financial products to small business owners facing the greatest barriers. This year, CEDS Finance deployed $3.5 million to 110 small businesses—primarily low-income, immigrant, refugee, and BIPOC entrepreneurs. Each dollar invested fuels dreams, strengthens communities, and builds a more inclusive economy where all entrepreneurs have the chance to succeed.

2024 RECOGNITION

Karen Dabson Award: Yolanda Huillca (pictured middle), Portfolio Officer, was honored by the Credit Builders Alliance for her impactful work in credit building.

State Board Appointment: Alex Wise, Executive Director, was appointed to serve on the Colorado Circular Communities (C3) Enterprise board.

2024 HIGHLIGHTS

CEDS Finance believes that economic empowerment starts with community. Its impact extends beyond lending. CEDS Finance’s lending breaks barriers, provides access to capital, and builds trust to create lasting opportunities for underserved entrepreneurs. Three key highlights reflect our commitment to strengthening communities and fostering financial inclusion.

BREAKING BARRIERS

Serves 87% extremely low to low income borrowers. 2024 capital programs were specifically designed to provide support to these clients.

ACCESS TO CAPITAL

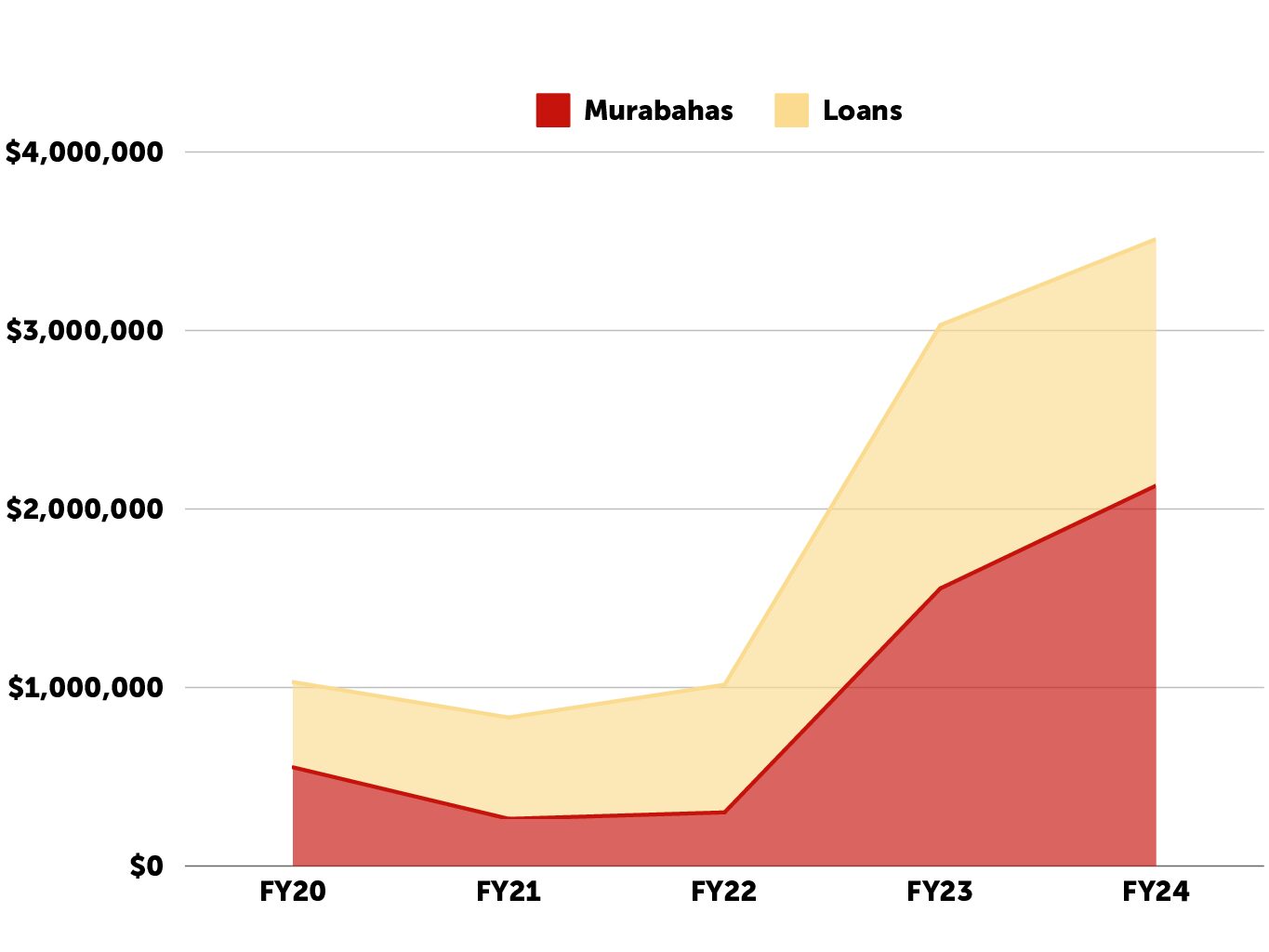

Grew total lending by 16% with a 37% increase in Islamic Compliant Debt

(FY24 v FY23)

BUILDING TRUST

Partnerships are the building blocks of community development. In FY24, 78% of inquiries came through 57 trusted partners.

Breaking Barriers

SERVING LOW INCOME BUSINESS OWNERS

DELIVERED $375K IN GRANTS

CEDS Finance designed, implemented, and executed a $375,000 grant program through the Colorado Startup Loan Fund, funded by The Colorado Office of Economic Development and International Trade (OEDIT). The program provided $5,000 grants to 71 extremely low-income entrepreneurs, helping them grow and sustain their businesses. This initiative fuels our mission to break down barriers to capital, empower resilient entrepreneurs, and strengthen communities by fostering inclusive economic growth across Colorado.

I am so grateful that this program exists. You can have raw talent and the potential to do great things, but without resources to even the playing field, you end up taking your talent and potential to the grave.

Sandra Thebaud

StressAway, LLC (DENVER)

I felt very supported throughout the process, which is great for someone still navigating the lending world of owning a business. As a female entrepreneur and single mom, I’ve felt particularly supported, and I appreciate [CEDS FINANCE’S] diverse clientele and evident culture of inclusion.

EMILY MITCHELL

BOULDER BARKS

(LAFAYETTE)

Accessing Capital

MURABAHA LENDING

TOTAL IMPACT

Since 2011, CEDS Finance has offered Islamic-compliant financing (murabahas) in Colorado. Last year, a strong majority (60%) of dollars invested into communities were Islamic-compliant debt. Our proven expertise in designing, implementing, and managing murabaha products positions us as the only Islamic-compliant lender in Colorado and a partner for organizations seeking to start or expand their Islamic finance capabilities.

$7M

Deployed since 2011

220+

Business owners supported

20

Countries of Origin

MURABAHA LENDING

NATIONAL LEADERSHIP

This year, CEDS Finance presented at two national conventions—the Opportunity Finance Network’s (OFN) Small Business Finance Forum and CBA’s 2024 Credit Building Symposium—sharing insights on Islamic-compliant financing and its impact on the Islamic community.

OFN SMALL BUSINESS FORUM

FORT MORGAN SMALL BUSINESS FAIR

BUILDING COMMUNITY THROUGH INCLUSIVE FINANCE

The DBJ featured CEDS Finance as Colorado’s only Islamic-compliant lender.

“CEDS Finance’s Murabaha program allowed me to expand my business while honoring my religious principles. Their understanding of our community’s needs makes all the difference.”

– Abdirahman Ahmed Aden, Mile High Halal Market

EID-AL-ADHA CELEBRATION AT THE ISLAMIC OUTREACH CENTER OF CO

Local Community For Global Shoppers: AN Interview with Abdullahi Shongolo

In 1992, seven-year-old Abdullahi Shongolo embarked on a harrowing journey that most could hardly imagine. Fleeing Somalia’s civil war, he trekked through the jungle for two weeks, navigating encounters with hyenas, lions, and violent militias before finding safety in a Kenyan refugee camp. Twelve years later, he resettled in Denver, Colorado, where his life took a remarkable turn.

Shongolo owns Global Grocery Mart, a bustling international market serving Denver’s immigrant and refugee communities. His impact, however, extends far beyond the shelves stocked with rare spices and international treats to helping newcomers navigate immigration paperwork to connecting them with housing resources. For many, Shongolo has become a lifeline for many.

In this Q&A, Abdullahi shares his journey from refugee to entrepreneur, the challenges he faced, and his enduring mission that drives him to make a difference in his community.

Q: Abdullahi, can you start by telling us about your journey from Somalia to Denver?

Abdullahi: My journey started in 1992 when my family fled Somalia during the civil war. We walked for two weeks through the jungle to reach a refugee camp in Kenya, where we lived for 12 years. Life in the camp was extremely hard, but I learned English there, which helped me advocate for my family when we were selected for resettlement in the United States. In 2004, my parents my eight younger siblings, and I arrived in Denver. Starting over in a new country was challenging, but I was determined to succeed.

Q: What inspired you to open Global Grocery Mart?

Abdullahi: It all started when I met the owner of a small convenience store in my neighborhood. He offered to sell me the store, but I didn’t take him seriously at first. Eventually, I realized he saw potential in me, and I decided to pursue it.

The problem was that I didn’t have the money. My family and friends weren’t interested in partnering, so I thought it wouldn’t happen. Then the owner gave me a CEDS Finance business card. He told me they help refugees start businesses, so I gave them a call.

Q: How did CEDS Finance help turn your dream into reality?

Abdullahi: CEDS Finance was a game-changer for me. It was my first time owning a business, and they made the process so easy. I was able to secure the funding I needed. They didn’t just help me financially; they believed in me. That belief gave me the confidence to move forward. I paid back the loans early, and I’ve been growing the business ever since. Without CEDS Finance, I don’t think I’d be where I am today.

Q: How does your store support the local community, especially immigrants and refugees?

Abdullahi: My store is a home away from home for many. We stock food from all over the world — Africa, Asia, Latin America — so immigrants can find the flavors they grew up with. Beyond that, I help people with whatever they need. Some bring me letters they don’t understand, and I translate them. Others need help finding housing or accessing social services, and I guide them. I know how hard it is to adjust to a new country, so I do whatever I can to make their transition easier.

Q: What advice would you give to other immigrants and refugees who want to start their own businesses?

Abdullahi: My biggest advice is to take your time and do your research. Don’t rush into something just because it seems like a good opportunity. Make sure it’s something you’re passionate about. Every business has challenges, so you need to be prepared to face them. And don’t be afraid to ask for help.

Organizations like CEDS Finance are there to guide you. With determination and the right support, you can achieve your dreams.

Abdullahi Shongolo has built more than a grocery store—he’s created a space where immigrants and refugees find connection, comfort, and support. Global Grocery Mart is a business, and it’s a cultural hub that brings people from all over the world closer together. By sharing flavors from across the globe, Abdullahi helps newcomers feel at home while strengthening the bonds that make our communities richer and more connected.

Photo by Hyoung Chang/The Denver Post

BUILDING trust THROUGH vibrant partnerships

Strong partnerships create stronger communities. In FY24, 57 partner organizations connected small business owners to CEDS Finance, accounting for one-fifth of total inquiries. CEDS Finance also referred small business owners to our trusted partners more than 45 times for specialized technical assistance.

These relationships do more than share resources—they expand access to opportunity, reaching corners of the community that are often overlooked. Together, with our trusted partners with whom we have a cyclical relationship, we ensure that small business owners, no matter their background or barriers, have the right support they need at the right time.

TOP PARTNERS REFERRAL CELEBRATION & AWARDS EVENT AT ROOM FOR FRIENDs

FISCAL SPONSORSHIP

CEDS Finance officially became the fiscal sponsor of ShopBIPOC

BUSINESS GROWTH

Created 209 new business profiles in FY24

CORPORATE FUNDING

Secured its first grant dollars from corporate partners.

COMMUNITY GROWTH

FISCAL

SPONSORSHIP

Over 70 community members and partners came together for our second annual Iftar Dinner, celebrating cultural diversity and strengthening our support for the Muslim community.

HISPANIC

HERITAGE MONTH

We celebrated Hispanic Heritage Month with Nosotros Latinos Denver and the Latin American Educational Foundation, connecting with incredible Latina entrepreneurs who are shaping our community.

HMONG

NEW YEAR

The 41st Annual Colorado Hmong New Year brought the community together to honor heritage, unity, and tradition. We were grateful to support this celebration as a sponsor.

Building Community through business ownership

Maria Isabel

CAKE LAND (DENVER)

Thanks to CEDS Finance, I secured a loan that enabled me to purchase a new cake display case, expand my business, and rebrand from Denise’s Party Supplies to Cake Land. This support has been instrumental in our growth and success.

The clients CEDS Finance works with span the full spectrum of businesses – from startups to multi-generational legacies, from refugee business owners who’ve fled worn-torn countries to those with local roots in Colorado. What unites these diverse business owners is their determination, resourcefulness, and commitment to creating better lives for themselves and for their families. Each business generates net wealth for that individual and strengthens communities by functioning as cultural hubs and gathering spaces.

PRESERVING FAMILY LEGACIES

Cakeland (formerly Denisse Party Supplies) represents a family tradition transformed into community service. Owner Maria Isabel opened her doors in 2003, but her story begins much earlier – in her mother’s kitchen when she was seventeen and pregnant with her oldest daughter.

“I followed in my mother’s footsteps, first baking cakes at home before eventually opening my business,” Maria shares. “Making cakes has always been my passion, but I knew nothing about running a business.”

That’s where CEDS connected with Maria, providing financing to purchase equipment, invest in advertising, and ultimately rebrand her business. Beyond selling her own creations and supplies, Maria hosts regular community classes, teaching others to bake.

“As a business owner and baker for over 34 years, I’ve gained extensive knowledge in pastry making,” she says. “It’s important to me not to keep that knowledge to myself, but to share it with people who want to learn. Through that, I want to create a sweeter world and help those in my community gain skills for extra income.”

What makes Maria proudest is how her business has strengthened her connection to her mother, who passed away several years ago. “I feel like my mom is still with me. She started making cakes, and if I hadn’t seen her doing it, I wouldn’t be here now. So I keep her present with me every day through my work. Sometimes I even say, ‘Let’s bake together,’ and maybe that sounds crazy, but I know she’s with me.”

MULTIGENERATIONAL OWNERSHIP

Just five minutes down the road from Cakeland, you’ll walk into Gamino Printing in the Athmar Park neighborhood where you’ll meet Ron Gamino, who began working for the business when his father founded it in 1976. With support from Senator John Sandoval, who provided guidance on business fundamentals, Gamino Printing became the first Hispanic-owned union printing shop in Colorado – and in fact, the first union and minority-owned printing shop in a four-state region.

Just five minutes down the road from Cakeland, you’ll walk into Gamino Printing in the Athmar Park neighborhood where you’ll meet Ron Gamino, who began working for the business when his father founded it in 1976. With support from Senator John Sandoval, who provided guidance on business fundamentals, Gamino Printing became the first Hispanic-owned union printing shop in Colorado – and in fact, the first union and minority-owned printing shop in a four-state region.

Over its long history, the shop has built a nationwide client base, particularly among political organizations. Today, Ron has passed leadership to his own son, who joined full-time in 2015 and now manages the business operations, continuing a three-generation legacy.

“CEDS was a great help for me when I approached them,” Ron explains. “I was basically running the shop by myself when other loan institutions threw me aside. CEDS looked at what I wanted them to see – how well my business was running. That’s what made the difference. They gave me a chance when I really needed the boost.”

EMPOWERING IMMIGRANT BUSINESS OWNERS

Across from CEDS Finance’s office on East Colfax, I Love Me Gems has transformed from a personal passion into a vibrant community enterprise. Founder Yurima Crowley launched her jewelry-making business in June 2018, collaborating with immigrant women who meet weekly in a studio to create unique pieces sold at bazaars and community events.

With a small loan from CEDS Finance, Yurima overcame initial funding challenges, turning her artistic vision into a thriving business that provides both a creative outlet and supportive environment where women develop skills and entrepreneurial confidence. “CEDS was the first organization to support our business when we registered it,” Yurima notes. “They gave us our first loan without any previous experience or sales history. No one else would choose us. We used that loan, paid it off, and have continued growing.”

I Love Me Gems has evolved into more than a jewelry store – it’s a cultural hub where beauty and community converge, allowing immigrant women to feel valued and empowered. Looking ahead, Yurima plans to expand nationally and internationally, supporting more immigrant women through her craftsmanship.

YURIMA CROWLEY I LOVE ME GEMS (AURORA)

CEDS finance was the first organization to support our business when we registered it. We used our loan, and we paid it off and were able to keep growing.

CEDS finance came when I really needed the boost during a time when other loan institutions overlooked my business. They recognized the potential in how I ran my store and gave me the chance to grow.

Abdurahman Ahmed Mohamed dur dur (AURORA)

In Aurora on Havana Street, Durdur Wholesale and Retail LLC serves as another vital community connection. Since founding the business in June 2021, Abdurahman Ahmed Mohamed has built a thriving ethnic goods store specializing in clothes, carpets, beauty products, suits, and accessories from around the world.

Recognizing his community’s diverse needs, Abdurahman expanded to include remittance services. With a recent murabaha loan from CEDS Finance, he’s enhancing his inventory by sourcing premium products from Saudi Arabia, Dubai, and Turkey, allowing him to provide a wider selection to customers seeking familiar goods from their homelands.

“CEDS came when I really needed the boost during a time when other loan institutions overlooked my business,” Abdurah shares. “They recognized the potential in how I ran my store and gave me the chance to grow.”

These entrepreneurs represent just a handful of the many business owners CEDS Finance is humbled to support. Through their determination, creativity, and our belief in their potential, they’ve created spaces that strengthen Colorado’s communities, preserve cultural heritage, and build economic opportunity for future generations. These business owners haven’t just built successful enterprises – they’ve become essential threads in the fabric of Colorado’s neighborhoods and economy.

CEDS Finance TOTAL IMPACT since 2011

$13,774,126

INVESTED IN SMALL BUSINESSES

634

LOANS & Murabahas

80%

EXTREMELY LOW TO LOW INCOME

50%

U.S. BORN CLIENTS are AFRICAN AMERICAN

1,183

JOBS CREATED/ RETAINED

48

COUNTRIES OF ORIGIN

90%

BIPOC OWNED BUSINESSES

50%

StartUp Businesses

CEDS FINANCE looked at the way I ran my business and took into account how well it was doing. They gave me a chance.

RON GAMINO

GAMINO PRINTING (DENVER)

OUR STAFF

Alexandria Wise,

Executive Director

Yasir Abdulah,

Client Services Officer

Juan Carlos Rosales de la Garza,

Senior Investment Officer

Carrie Hanson,

Director of Development

Yolanda Huillca,

Portfolio Officer

Sayed Naqibullah,

Senior Investment Officer

Kelly Nichols,

Senior Business Support Officer

Micki O’Neil,

Director of Business Support

Shafi Osman,

Community Engagement Officer

Diana Padgett,

Director of Finance

Tony Pelz,

Director of Lending

Juan Pelaez,

Investment Officer

Daphne Sawi,

Senior Portfolio Officer

Barbara Smith,

Portfolio Officer

17

LANGUAGES SPOKEN BY THE TEAM

60%

BIPOC

14

TEAM MEMBERS FROM 10 COUNTRIES

MEET SAYED NAQIBULLAH

SENIOR INVESTMENT OFFICER

Originally from Afghanistan, Sayed Naqibullah moved to the United States in 2009 and earned a BS in Business from the State University of New York. He began his career at the Afghan Consulate in New York before returning to Afghanistan to support educational development.

At CEDS Finance, Sayed serves as an underwriter, dedicated to expanding access to capital for underserved communities. He believes each loan is a step toward building a more inclusive economy. Sayed has been the top loan producer for the last two years. Passionate about the Afghan diaspora, Sayed has authored “Learn Dari” for Afghan children abroad and “English for Farsi Speakers” for adult learners, enhancing both the financial and social well-being of his community.

MEET KELLY NICHOLS

SENIOR business consulting officer

Kelly Nichols joined CEDS Finance’s Business Support and Impact team in 2022, bringing over two decades of executive leadership in both private industry and non-profit management. Originally from Texas, she moved to Denver after earning an MA in Community Counseling and has since dedicated her career to empowering local small business owners. Passionate about equipping them with the resources and education they need to thrive, Kelly goes above and beyond to ensure every client receives the right support. When a Russian-speaking entrepreneur needed accounting guidance, she personally connected them with a QuickBooks-certified bookkeeper who spoke their native language—ensuring they had the tools and support to succeed. Kelly is committed to building inclusive communities where entrepreneurs have the opportunity to achieve their full potential.

FINANCIAL REPORT

2024

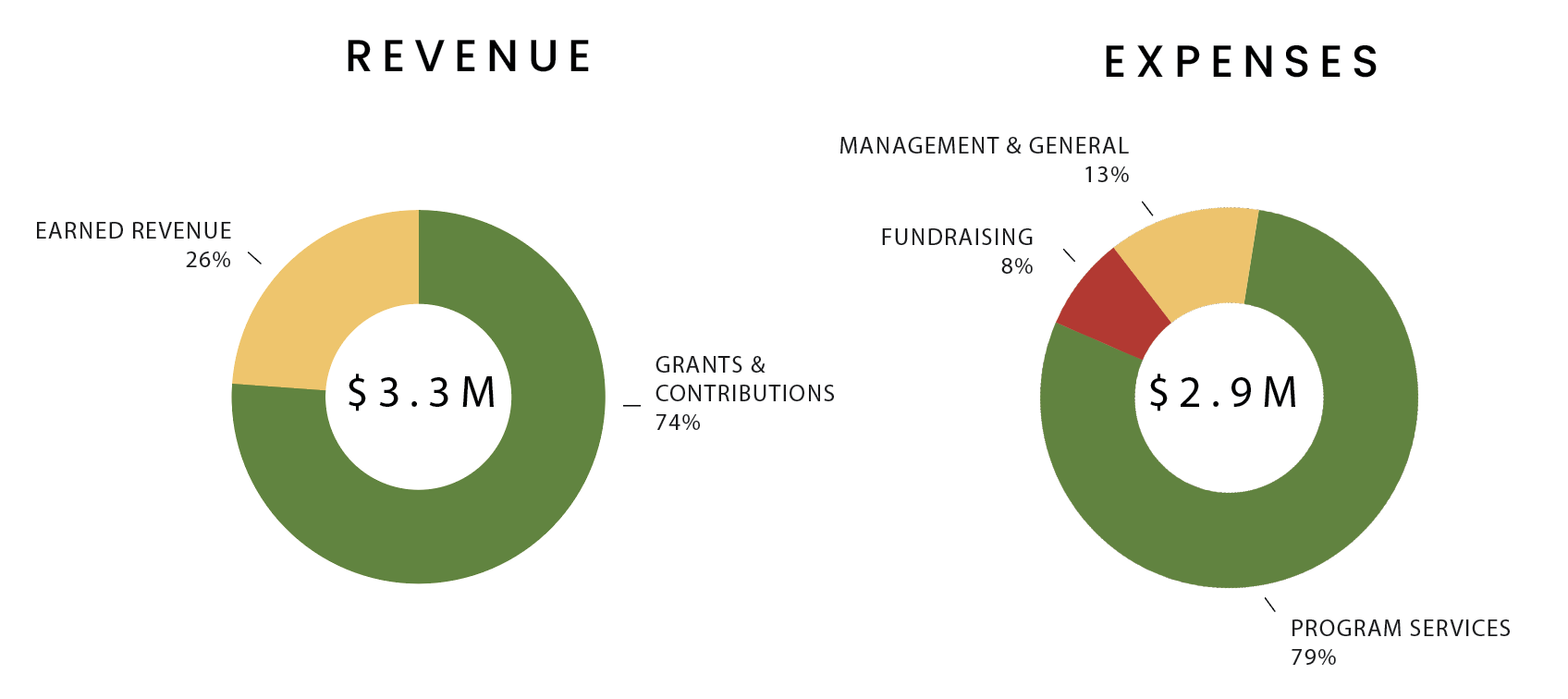

CEDS Finance maintained strong financial health while expanding our impact in 2024. Total revenue grew by 27% to $3.3M, allowing us to serve more small business owners.

Our financial statements are audited annually by Olson, Reyes & Sauerwein, LLC. CEDS Finance is proud to hold a four-star rating from Charity Navigator and a Platinum Seal of Transparency from Guidestar.

OUR BOARD

Jonalyn Denlinger,

J Denlinger Consulting

Board Chair

Patrick Horvath,

Center for Community

Wealth Building

Board Vice Chair

Sarah Montgomery,

Espire Dental

Board Treasurer

Nicole Carner,

Early Strategy

Impact Companies

Board Secretary

Arlene Delgado,

Encore Bank

Board Member

Timothy Floyd,

Alpine Bank

Board Member

Jeremy Harkey,

Groundswell Ventures

Board Member

William Hunter Railey,

Colorado Dept.

of the Treasury

Board Member

Karol Jones,

B:Side Capital & B:Side Fund

Board Member

John Palyo,

CDFI Industry Leader

Board Member

Marie Peters,

B-Side Capital

Board Member

Jessica Sveen,

Rocky Mountain

Microfinance Institution

Board Member

STATEMENT OF ACTIVITIES

THANK YOU

to our fy24 investors

$ 1M +

Small Business Administration (SBA)

$ 100K +

Community Development Financial Institution (CDFI)

The Dakota Foundation

U.S. Bank Foundation

United Business Bank

$ 50K +

Capital One Foundation

Rose Community Foundation

$ 10K +

Bank of America

Mile High United Way

National Association for Latino Community Asset Builders (NALCAB)

PNC Bank

Scale Link

The Colorado Trust

Wells Fargo

$ 1K +

Alpine Bank

Anschutz Family Foundation

BMO Harris

Encore Bank

Espire Dental

Huntington National Bank

The Denver Foundation

UP TO $ 1K +

Amy and Tim Getzoff

Carrie Hanson

Colorado Gives Foundation

Colorado Office of Economic Development and International Trade (OEDIT)

Debra Brown

Ed Briscoe

Jennifer Derse

Jeremy Harkey

Jessica Sveen

Jorge Aburto Sanchez

John Horvath

John Paylo

Jonalyn Denlinger

Joshua Peebles

Karol Jones

Marie Peters

Megan Rauker

Michele Sienkiewicz

Mile High Ministries Denver Urban Semester

National Community Reinvestment Coalition (NCRC)

Nicole Carner

Patrick Horvath

Small Business Majority

LOAN FUND

INVESTORS

Anonymous

Colorado Health Foundation

Colorado Housing and Finance Authority (CHFA)

Department of Local Affairs (DOLA)

Kenneth King Foundation

Small Business Administration (SBA)

The Dakota Foundation

The Denver Foundation

United Business Bank

Women’s Foundation of Colorado

I’m proud to be a CEDS board member because we truly listen to our communities. Our team ensures our strategies meet the needs of inspiring small business owners, whom we consider family, not just customers.

PATRICK HORVATH

BOARD VICE-CHAIR

Expanding Access to Capital: Partner Outreach Program

At CEDS Finance, we connect underserved entrepreneurs with critical funding and business support through our Partner Outreach Program (POP) in collaboration with The Colorado Office of Economic Development and International Trade (OEDIT) .

What We Do

Bridge the gap between small businesses and state-funded financial resources

Provide 1:1 coaching to navigate funding and business challenges

Expand outreach to BIPOC, immigrant, refugee, and rural entrepreneurs

State Programs We Connect Clients With

Colorado Startup Loan Fund

CLIMBER Loan Fund

Colorado Credit Reserve & Cash Collateral Support

Colorado Revolving Loan Fund

SSBCI & SBDC Technical Assistance

The financial support from CEDS Finance has been instrumental in expanding our client base and solidifying our presence in the market. Thank you, CEDS Finance, for your invaluable assistance and commitment to supporting small businesses.

Dorsin Kulembwa

Grant Recipient of Colorado Startup Loan Fund, an OEDIT program

DORSIN KULEMBWA

NEW-N-SPOTLESS

(DENVER)

Contact :

Phone : (303) 569-8165

Email : info@cedsfinance.org

Web : www.cedsfinance.org

Social : @cedsfinance

Address :

10660 E Colfax Ave, Suite B

Aurora, CO 80010

PICTURED ON COVER

(LEFT TO RIGHT)

Fátima Boylen: Boylen Cleaning Services

Darnell Smith: Grey Goat Transportation

Alberta Hernandez: Safari Smiles

Abdurahman Ahmed Mohamed: DurDur Whole and Retail

Ademola Michael Okubena: Rubicon Wellness

Sabrina Harris: Walking By Faith Learning Center

Hana Mengesha: Precision Clinical Laboratory

Prepared by consultants, Carly Williams & Kanitha Heng Snow