Impact Report

Fiscal Year 2023

VIBRANT COMMUNITIES.

EMPOWERING BUSINESS OWNERSHIP.

October 2022-September 2023

Table of Contents

11. In The Community

12. Financial Report

13. FY23 Investors

14. Our Staff and Board

15. Looking Forward

MESSAGE FROM LEADERSHIP

CEDS Finance proudly serves small business owners in Metro Denver, Weld, and Morgan Counties with culturally responsive financial products, business grants and personalized one-on-one consulting support.

“TOGETHER, WE HAVE ACHIEVED REMARKABLE GROWTH AND SUCCESS, INVESTING OVER $10 MILLION IN SMALL BUSINESS OWNERSHIP THROUGH 523 LOANS TO IMPACT 1,520 JOBS SINCE OUR FOUNDING.”

Dear CEDS Finance Community,

Our journey at CEDS Finance has been nothing short of remarkable, and I am immensely proud to announce the significant strides we’ve made in FY23.

Tripled Production, Tangible Results

Since my arrival at CEDS Finance in FY17, I have witnessed firsthand the dedication and hard work of our exceptional team. Together, we have achieved remarkable growth and success increasing our total assets by 10x. In the past year alone, CEDS Finance has tripled its production, a testament to the commitment and passion of our team. These tangible results underscore our collective efforts to support all entrepreneurs regardless of race, creed, or economic standing.

Expanding Our Portfolio and Impact

Our expanded portfolio speaks directly to our increased impact we are making in the community. To date, we have created and retained 1,520 jobs in Colorado. CEDS Finance has doubled our portfolio in just one year. This expansion allows us to support even more individuals and businesses in need.

Reaching New Communities: Weld and Morgan Counties

One of the most exciting developments in FY23 has been our strategic move to expand services into Weld and Morgan Counties with a particular eye towards Muslim small business owners. By doing so, we extend our mission beyond our existing footprint, reaching new communities with unique needs, while remaining steadfast in empowering individuals who face the greatest barriers to getting capital and starting and growing their businesses.

The Power of Strong Partnerships

Our success is not achieved in isolation. It is a result of the strong partnerships we have cultivated with and across the community – 50 partner organizations referred clients to us in FY23. These partnerships are essential in realizing our shared goals and helping our clients achieve the American Dream of self-sufficiency.

ALEXANDRIA E WISE

![]()

KAROL JONES

Reiva & Yon Cruze, Owners of TumbleHaus Visit Tumblehaus>>

ABOUT CEDS FINANCE

Mission & Values

Founded in 2009, Community Enterprise Development Services (CEDS Finance) is a non-profit, mission-driven lender and Community Development Financial Institution (CDFI) that provides capital to underserved small business owners in Metro Denver and now in Morgan and Weld Counties. It helps small business owners realize their dreams by providing access to flexible capital and free business consulting. For many CEDS Finance’s clients, it is the first rung on the capital ladder.

OUR MISSION

CEDS Finance supports the American Dream of financial self-sufficiency by assisting refugees, immigrants, and those from underserved communities to start or grow their small business in Metro Denver and empower themselves financially.

WHAT SETS US APART

- No Credit Score Minimum

- Collateral-Free Loans up to $50,000

- Character-Based Underwriting

- Only Islamic-Compliant lender in Colorado

- 16 Languages Spoken by Staff

Paul Stein, co-founder of CEDS Finance with Abdella Mudesir, owner of Yummy Pop

Our Story

In 2009, Paul Stein and Sisay Teklu, a refugee services expert and an Ethiopian immigrant, identified a financing gap for immigrants and refugees pursuing entrepreneurial goals in Metro Denver. With a vision of empowering all Americans, CEDS Finance was established. Since then, CEDS Finance has been dedicated to supporting the most vulnerable populations excluded from the traditional financial system. Initially focusing on refugee-owned businesses, CEDS Finance expanded its support to include immigrant-owned and U.S.-born businesses in 2017 to meet growing demand. Today, CEDS Finance invests in and supports low-income and BIPOC business owners in Metro Denver, Morgan and Weld Counties, and provides Islamic compliant lending – murabahas – throughout Colorado.

Awards

- 2023 Colorado Community Lender of the Year (SBA)

- 2023 Microlender Accelerator Program SELECTEE (Aspen Institute)

- 2019 Diversity & Inclusion Champion Award (Aurora Chamber of Commerce)

- 2018 Colorado Community Lender of the Year (SBA)

- 6-Time CDFI Fund Awardee

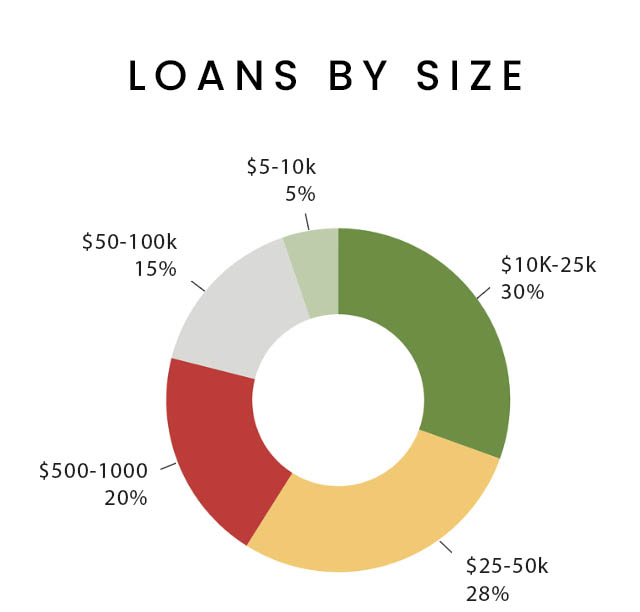

Our Programs

Financial Products

CEDS Finance offers three debt products tailored to small business owners, each customizable as either an interest-based loan or riba-free debt (Islamic-compliant murabaha).

Our Funding Options Support

- Startups & Existing Small Businesses

- No Minimum Credit Score

- Competitive FIXED Interest Rates

- No Collateral <$50k

SPARK

Up to $5k

(Up to $15k in FY24)

ELEVATE

Up to $50k

AMPLIFY

Up to $100k

Community is not just about physical spaces; it’s about creating spaces that bring people together.

Cornelius Wright,

Owner of Cigar King

Business Technical Assistance

CEDS Finance provides free business support services to applicants and clients, guiding them towards readiness for capital investment and business growth. One-on-one business support is tailored to individual business needs and owners’ unique requirements. Support is offered in multiple languages and is culturally responsive.

Free Services

- One-on-One Support

- Partnership Referrals

- Technical Assistance Grants

- Webinars & Workshops

Top Support Areas

- Accounting

- Marketing

- Business Compliance

Our 2023 Impact

A Culturally Responsive Approach

CEDS Finance prioritizes a culturally responsive approach to working with all clients. Recently, when a client who spoke only Russian required accounting education, she was connected to a local Quickbooks certified, native Russian-speaking bookkeeper. This personalized approach improved our client’s ability to manage her finances, and resulted in her understanding her profitability and identifying areas for growth.

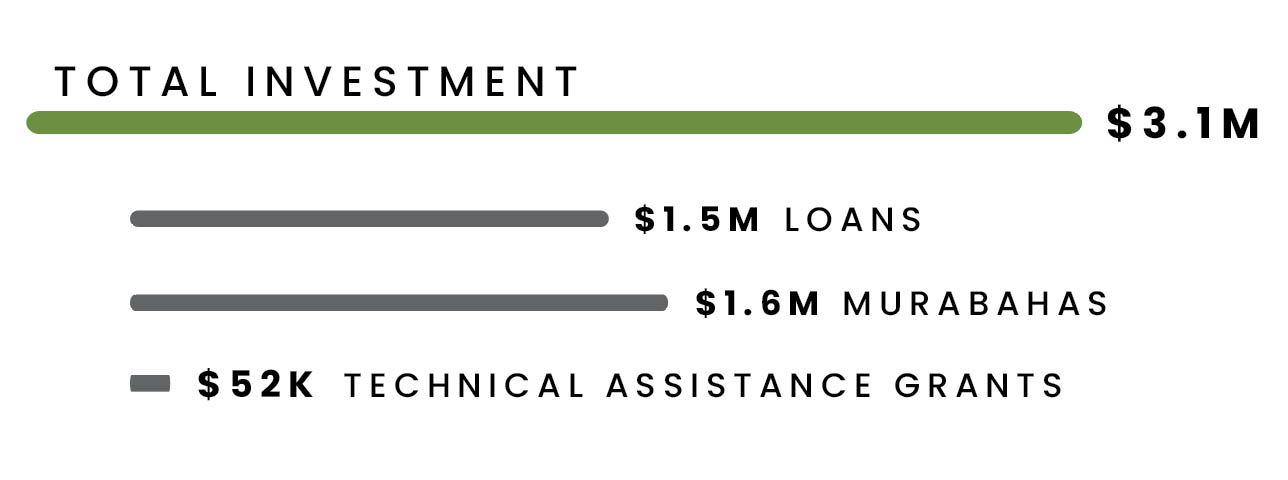

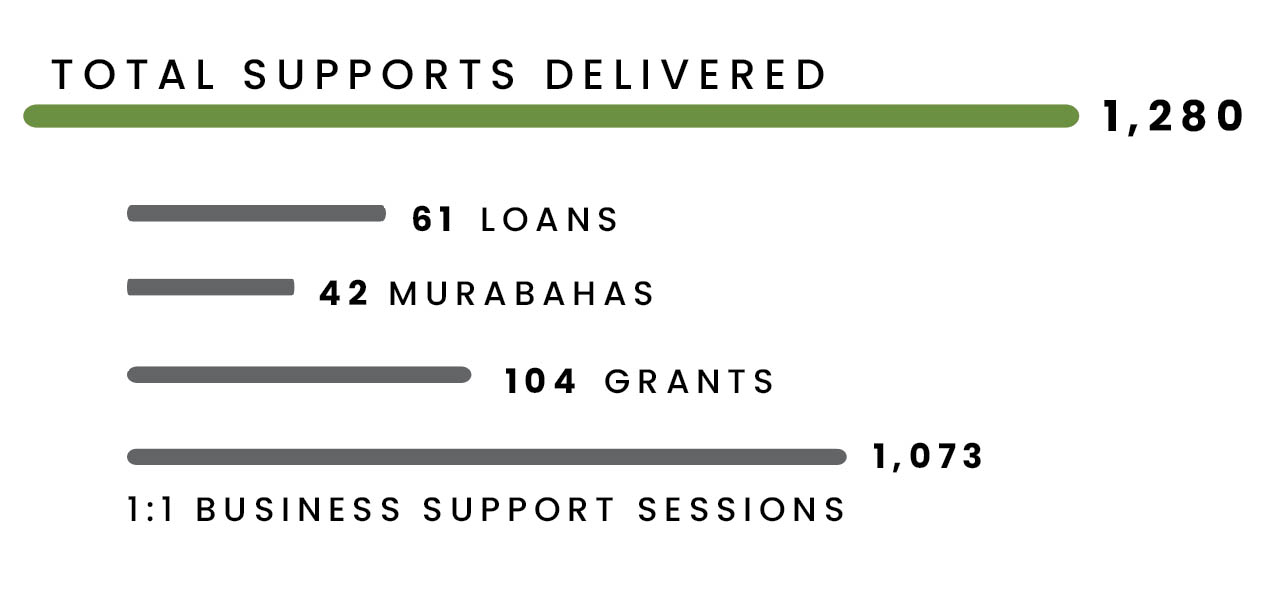

TOTAL INVESTMENT in Small Business

Funding & Technical Assistance

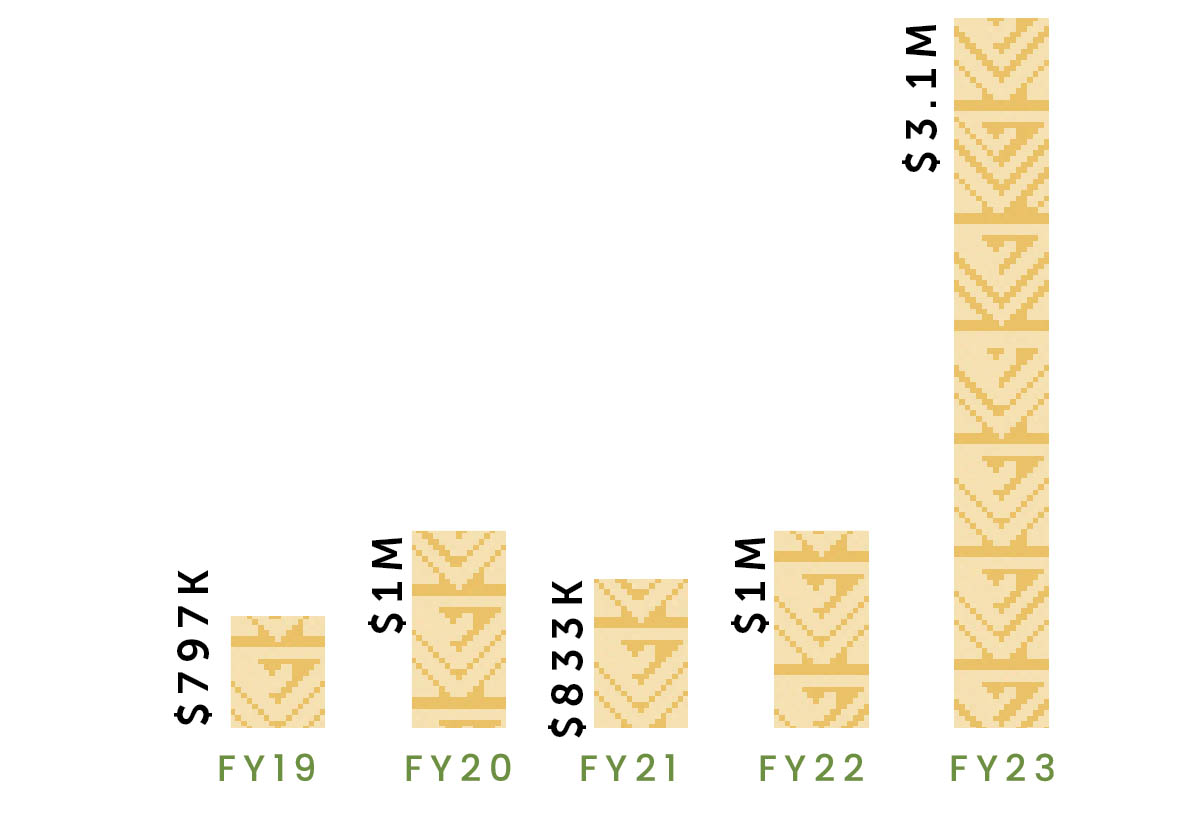

Our Annual Deployment

2023 Growth

In 2023, CEDS Finance tripled its lending into the communities’ smallest businesses.

our cumulative impact

CEDS Finance strives to be the first rung on the capital ladder for small business owners. Because of how it has intentionally designed its financial products to be flexible and accessible, CEDS Finance has been able to serve business owners who face the greatest barriers to accessing capital.

523

Loans

$10.3M+

Total Invested

$4M+

in Muslim Community

1,520

Jobs Created/Retained

43

Countries of Origin

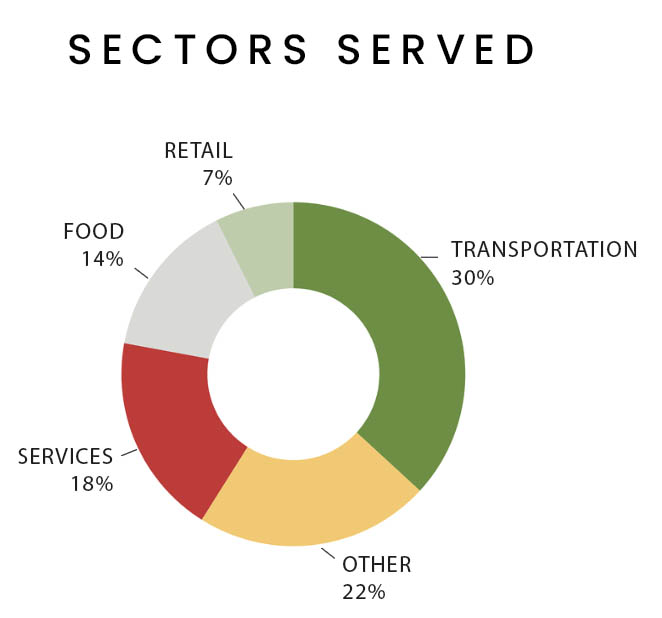

WHO WE SERVE

low income status

bipoc-owned businesses

immigrant and

refugee-owned businesses

startup businesses

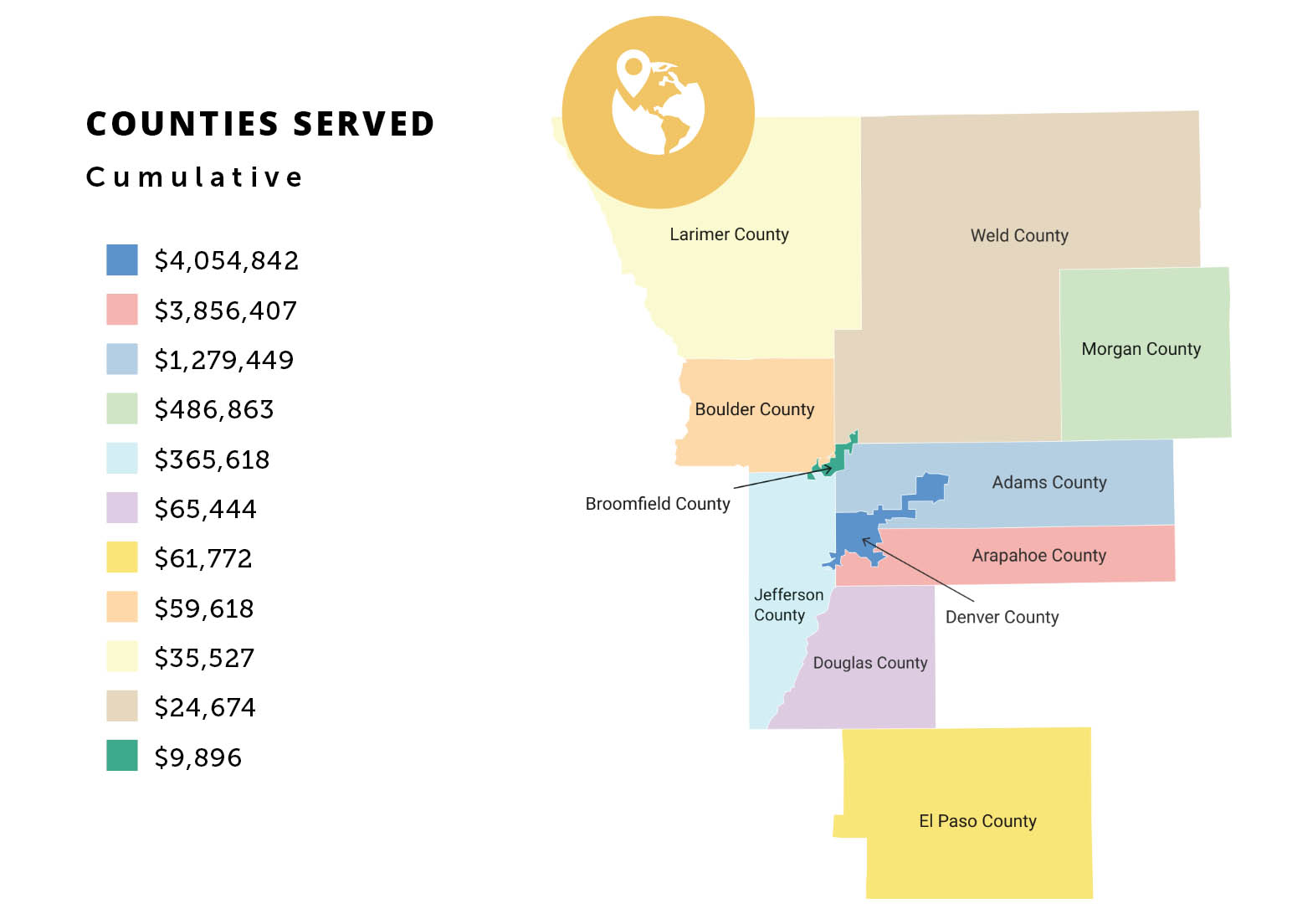

our geographic impact

CEDS Finance is proud to be the only CDFI located in Aurora. Since its founding, 90% of the small businesses it serves are based in Denver and Aurora. This year, it expanded its impact to Weld and Morgan Counties, which saw $301,375 across five small businesses.

East colfax & rural lending

Place Based Lending

East Colfax: In FY23 CEDS invested in 24 small businesses along the East Colfax Corridor for a total of $804,975. Two funders have committed resources dedicated to the East Colfax corridor. These investments contribute to building more vibrant neighborhoods with economic opportunities and valuable services.

Morgan and Weld Counties: In its first expansion outside Metro Denver, CEDS Finance has expanded its services to rural communities, including rural immigrant and refugee populations.

OUR KEY COLLABORATIONS

ShopBIPOC

CEDS Finance is a founding partner of ShopBIPOC, as well as the ficuciary. CEDS is thrilled to share the success of the ShopBIPOC Launch Celebration in 2023, made possible by the collective efforts of ten outstanding non-profits that comprise the ShopBIPOC collaborative. The launch marked the official unveiling of the platform, www.ShopBIPOC.com, connecting consumers with local BIPOC (Black, Indigenous, People of Color)-owned businesses. Supporting and purchasing from these enterprises aligns consumer dollars with a commitment to racial equity and the reduction of the racial wealth gap and supporting minority-owned businesses.

Top Referral Partners

- B- Side Fund

- City of Denver / Denver Economic Development & Opportunity

- Colorado Enterprise Fund

- Colorado Small Business Development Center Network

- Mi Casa Resource Center

- Office of Economic Development and International Trade

- Small Business Administration

ShopBIPOC Collaborative Partners at the Launch Event

in the news

“SHOPBIPOC LAUNCHES FREE ONLINE MARKETPLACE”

DENVER7 highlighted the launch of ShopBIPOC, with CEDS Finance serving as a founding partner and fiduciary to actively contribute to market expansion for BIPOC-owned businesses in Colorado.

“A FINANCIAL LIFELINE FOR IMMIGRANTS”

CPR featured the story of Josphat Ombacho, a Kenyan immigrant, whose culinary passion blossomed into Msosi Kenyan Cuisine. With support from CEDS Finance, Josphat turned his dream into a thriving business.

“THINGS 4: DACA AND THE DREAMERS”

The THINGS podcast delved into the challenges and opportunities faced by DACA recipients. CEDS Finance was interviewed, highlighting its role in providing support and financial resources.

BUSINESS SUCCESS STORY

Sabrina Harris, Owner of Walking by Faith Early Childcare Center

Sabrina launched her early childcare center in January 2024, serving the Montbello and Green Valley communities. Her philosophy is to spread love, peace, and equal opportunities for children under five. Sabrina received a startup loan from CEDS Finance in 2023 to open Walking by Faith. Through her business, Sabrina has created four jobs, and she is eager to employ more women in the future by opening additional classrooms.

“What inspired me to start my business was witnessing my grandmother operate her in-home childcare business for over a decade. That inspired me to go to college, and operate my own center. I love being able to watch the children grow and meet their different milestones. I also love being able to support the Montbello community, which is a daycare desert. Being able to open up my doors to families that need child care is important to me and my community.”

Sabrina harris,

Owner of walking by faith

early childcare center

in the Community

Fostering active participation and meaningful engagement within Colorado’s small business community stands as a core priority for CEDS Finance. Its leaders regularly participate as keynote speakers in both local and national events, conduct tailored workshops aimed at empowering small business owners, and celebrate the vibrancy of the entrepreneurs they support through initiatives such as its annual Iftar dinner.

shafi osman, community engagement officer, supported ADELANTE COMMUNITY DEVELOPMENT’s graduation day for latino business owners

70 business owners participated in ceds finance’s annual IFTAR CELEBRATION

CEDS Finance joined the community for Ethiopian New Year where business owners showcased their products, food, and traditions

Yolanda HUILLCA, Portfolio Officer, attended the unveiling of Unidos mural that celebrates the 200th anniversary of diplomatic relations between Mexico and the united states

executive director alexANDRIA wise spoke at the 16th annual veterans small business conference

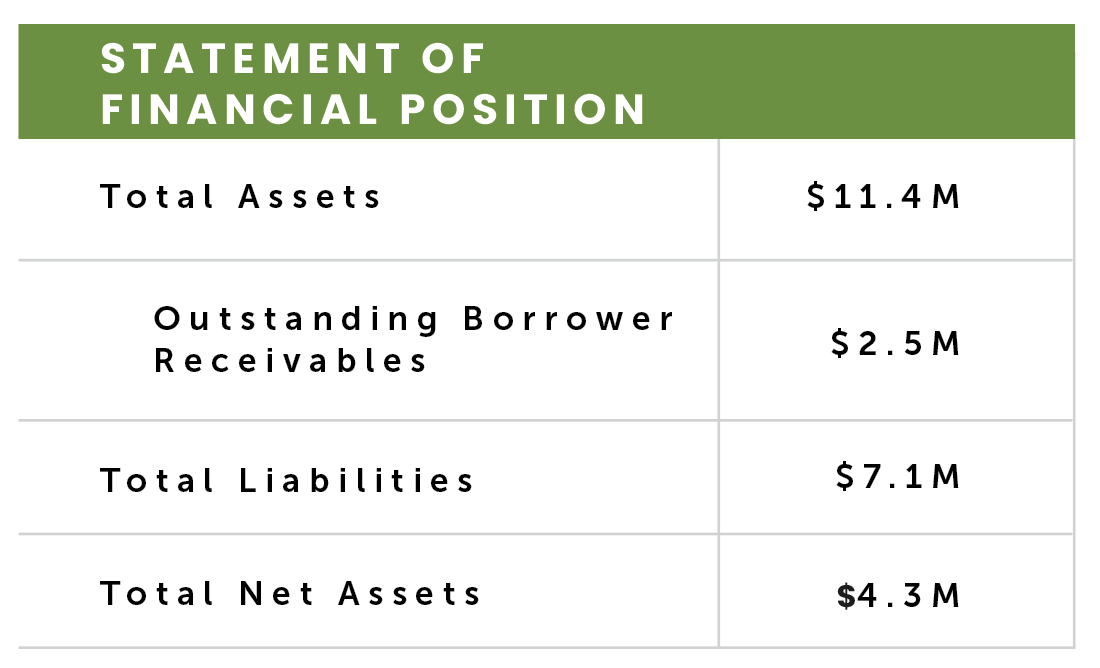

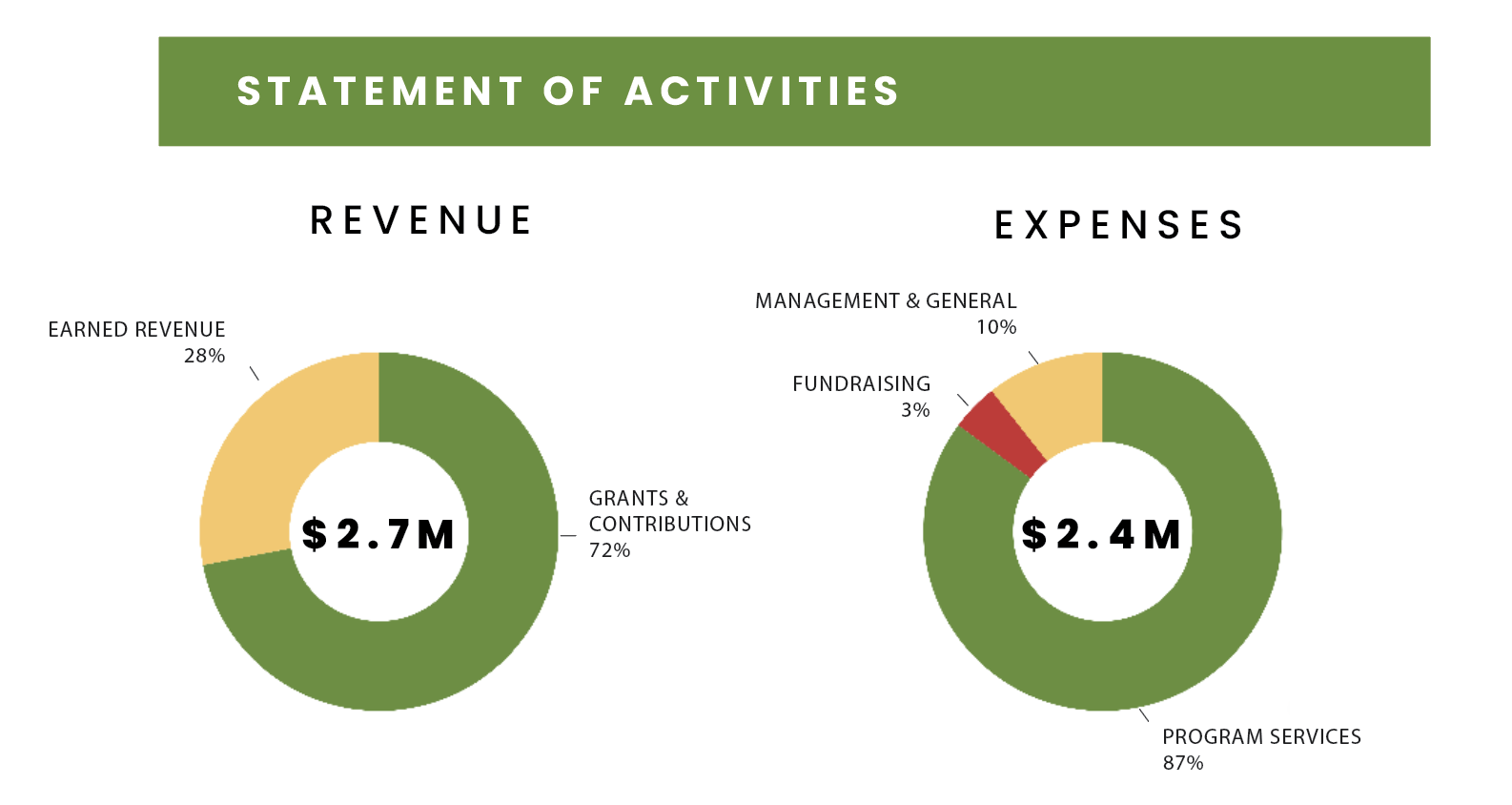

financial report

2023

In FY23 the CEDS Finance team achieved remarkable growth, deploying $3.1 million in loans, a threefold increase from the previous year. This surge in deployment resulted in a 70% increase to our outstanding portfolio and 50% increase in total assets.

3X DOLLARS DEPLOYED

(FY23 v FY22)

50% INCREASE IN TOTAL ASSETS

(FY23 v FY22)

70% INCREASE IN OUTSTANDING PORTFOLIO

(FY23 v FY22)

BUSINESS SUCCESS STORY

Simon Lagos Dominguez, Owner of Cherry Bean Coffee

Simon Humberto Lagos Dominguez, originally from Honduras, is a coffee enthusiast. He established Cherry Bean LLC in Colorado in 2014 marking the beginning of his journey as an American business owner.

Simon received his first loan from CEDS Finance to expand Cherry Bean into their second location. CEDS has provided three more loans as Cherry Bean has expanded.

Today, Simon has eight employees across two locations and continues to provide great community meeting spots and excellent beverages at Tennyson and South Broadway.

CEDS understood the unique challenges I faced as an immigrant business owner and provided valuable advice and support every step of the way.

THANK YOU

to our fy23 investors

CEDS Finance extends deep gratitude to all of our supporters. Investment in small business diversity ensures economic empowerment and economic justice for the marginalized communities we serve.

$1M+

The Colorado Health Foundation

$500k+

Office of Economic Development and International Trade

$100k+

Denver Economic Development & Opportunity

Department of Local Affairs

JP Morgan Chase Foundation

Kaiser Permanente Foundation

Small Business Administration

The Denver Foundation

$25k+

Capital One Foundation

Kenneth King Foundation

Rose Community Foundation

Wells Fargo Foundation

$1k+

Bank of America Charitable Foundation

Build from Within Alliance

City of Aurora

PNC Foundation

ScaleLink

Syntrinsic Investment Council

Up to $1k+

Amazon

Andrea Armstrong Shultz

Colorado Gives 365

Deborah R Klein

Debra Brown

Ed Briscoe

John Linton

Jonalyn Denlinger

Joshua Feiger

Karol Jones

Maria Gonzalez

Marie Peters

Nicole Carner

Patrick Horvath

Spencer Family Foundation

LOAN FUND INVESTORS

Anonymous

Colorado Home Finance Authority

Colorado Health Foundation

Denver Economic Development & Opportunity

Department of Local Affairs

Kenneth King Foundation

Office of Economic Development & International Trade

Small Business Administration

The Denver Foundation

Wells Fargo Foundation

Women’s Foundation of Colorado

CEDS Finance staff at the 2023 SBA Community Lender of the Year Awards Ceremony alongside Tacos La Tapatia, A CLIENT THAT RECEIVED THE SBA WALL OF FAME AWARD

Our Staff

Barbara Fosu, Operations Officer

Carrie Hanson, Director of Development

Yolanda Huillca, Portfolio Officer

Sayed Naqibullah, Senior Investment Officer

Kelly Nichols, Senior Business Support Officer

Micki O’Neil, Director of Business Support

Shafi Osman, Community Engagement Officer

Diana Padgett, Director of Finance

Juan Pelaez, Investment Officer

Tony Pelz, Director of Lending

Juan Carlos Rosales de la Garza, Senior Investment Officer

Daphne Sawi, Senior Portfolio Officer

Barbara Smith, Portfolio Officer

Flaubert Toulaboe, Investment Officer

Carly Williams, Communications Officer

Alex Wise, Executive Director

MEET THE TEAM

SHAFI OSMAN

COMMUNITY ENGAGEMENT OFFICER

Born and raised in the Somali Regional State, Ethiopia, Shafi Osman is a dedicated community and human rights activist with experience in community engagement. Fluent in Somali, Arabic, Amharic, and English, Shafi has spent over a decade working with local and international refugee agencies, serving as a consultant and case navigator for East Africa’s refugee, immigrant, and asylum-seeking populations, facilitating their access to services and local integration. As a co-founder and former executive director of the human rights advocacy organization Aflax Aid in East Africa, Shafi has demonstrated a commitment to supporting marginalized communities. After spending several years as a refugee in Uganda, Shafi was reunited with his family in Colorado on June 2, 2022. Shafi’s community leadership experience is invaluable to the CEDS Finance’s team work and presence supporting local communities.

Thanks to Mr. Paul Stein’s recommendation, I joined the CEDS Finance team, and the work and staff have been extraordinary. They are like family to me.

Meet the Team

Barbara Fosu

OPERATIONS OFFICER

Barbara Fosu, born and raised in Ghana until the age of 13, experienced a significant transition when her parents decided to pursue greater career opportunities in the United States. Winning the US Visa lottery in 2008, Barbara and her family relocated to New York City before settling in Colorado the following year. As the third of four siblings, Barbara is fluent in both English and Twi, having learned both languages simultaneously from her bilingual father. She has also been studying Spanish and looks forward to adding it as her third language. Barbara completed her high school education in Aurora and pursued her college years at the University of Colorado Boulder. With a passion for music, fashion, and dance, as well as a love for ocean beaches, Barbara enjoys immersing herself in diverse cultures and experiences.

I enjoy getting the chance to connect with clients on a whole different level. Being at CEDS FINANCE has been wonderful, and I truly enjoy working with the team.

Our Board

Jonalyn Denlinger

Board Chair

J Denlinger Consulting

Patrick horvath

Board Vice-Chair

Center for Community Wealth Building

josh peebles

Treasurer

Encore Bank

nicole carner

Secretary

Consultant to Early Strategy Impact Companies

JORGE ABURTO

Adelante Community Development

TRICIA ALLEN

Economic Development Association for Black Communities

Arlene Delgado

Encore Bank

jeremy harkey

Groundswell Ventures

Karol jones

B:Side Capital & B:Side Fund

Sarah Montgomery

Espire Dental

john palyo

Working Solutions

Hunter Railey

Colorado Department of the Treasury

It has been an honor and privilege to support CEDS FINANCE in its growth and expansion as a board member. I am excited to see our own board development and capacity expand to meet the organizational vision and to guide with our diverse, unique perspectives.

JONALYN DENLINGER

BOARD CHAIR

Looking Forward

CEDS Finance remains dedicated to serving low-income communities in the future, with a continued focus on supporting BIPOC business owners. CEDS Finance aims to grow lending and expand its progressive approach to credit to reduce barriers to capital for its target market. Additionally, it is excited to announce an increased Spark Loan limit to $15,000, ensuring accessible capital opportunities for current and aspiring entrepreneurs. Over the past 13 years, CEDS Finance has remained steadfast in its commitment to low-income and BIPOC communities, and will remain committed in the future. Stay tuned for more updates as CEDS Finance continues its mission to foster financial stability and prosperity within its communities.

Mulugeta’s Thriving

Trucking Business

Mulugeta Hadgu received a loan and business support services from CEDS Finance. Mulugeta returned to the CEDS Finance office to express his gratitude and gifted the team a painting of his home in Ethiopia. CEDS Finance is honored to assist small business owners like Mulugeta.

“i have plans to grow my business. When I have the money [through my murabaha], I will have more products and more customers…I can do it.”

Abdurahman Ahmed Mohamed, Owner of Durdur Wholesale and Retail LLC

Contact :

Phone : (303) 569-8165

Email : info@cedsfinance.org

Web : www.cedsfinance.org

Social : @cedsfinance

Address :

10660 E Colfax Ave, Suite B

Aurora, CO 80010