Download a PDF version of FAQs here (available in the languages listed below):

Watch a walkthrough of the entire grant application in English and Spanish

Watch a recording of the Small Business Grants Info Session here.

About

Provide financial support to underserved Colorado businesses, aiming to bridge gaps in capital accessibility for startups and existing small businesses. Our goal is to fuel statewide economic development with a focus on equity, diversity, and inclusion.

To qualify, applicants must meet the following Eligibility Criteria. Business(es) must be/have:

- Registered and in good standing with the Colorado Secretary of State;

- You can watch a recording of our webinar here, which covers verifying the Good Standing status of registered businesses and correcting it if necessary. Additionally, we provide guidance on registering sole proprietorships that have been reported on taxes but have not yet been registered with the state.

- Have their primary business activities and the majority of employees in Colorado

- For-profit small businesses;

- 2022 or 2023 tax forms that show business operations;

- No more than 25 full-time equivalent employees;

- No more than $2 million in gross annual revenue in the preceding fiscal year; and

- Have met at least one definition of an underserved* small business.

Complete grant applications will be prioritized based on income status and then on a first-come, first-served basis

Each grant is valued at $5,000, and we’re disbursing a total of $355,000 in grants.

Applications are open from May 1, 2024, at 10:00 AM to May 3, 2024, at 5:00 PM. No grant applications will be accepted outside this timeframe.

While there are no restrictions on how the grant funds are used, CEDS Finance strongly recommends that Awardees use them to strengthen their business finances.

An underserved business (as defined by OEDIT) is one that is majority-owned (51% or greater) by individuals from one or more of the following groups:

- Ethnic or racial minority group(s);

- Refugee(s) or immigrant(s);

- Women;

- Individuals with disabilities;

- LGBTQ+ individuals;

- Veterans;

- Residents of rural counties in Colorado are defined as those with a population of less than 250,000, according to the most recent U.S. Census data; and/or

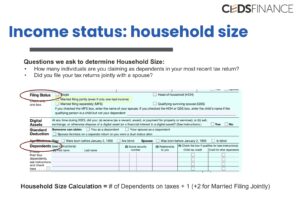

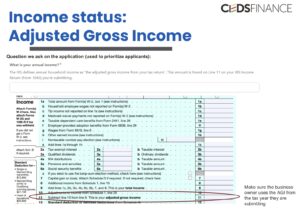

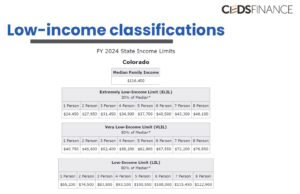

- Individuals with a low-income status are defined as having an Adjusted Gross Income (AGI) that is 80% or less than the median income for the state of Colorado, as determined by the latest HUD publications.

- This inclusive approach ensures that our support reaches those who need it most, promoting diversity, equity, and economic growth throughout Colorado’s small business sector.

Grant Eligibility

Yes, you may live outside of Colorado, but your business must be registered and primarily operate in Colorado, with the majority of your employees based in the state.

No. Only businesses registered with the Colorado Secretary of State are eligible. Businesses must be in good standing with the Secretary of State of Colorado. Businesses must have a 2022 or 2023 tax return document.

- You can watch a recording of our webinar here, which covers verifying the Good Standing status of registered businesses and correcting it if necessary. Additionally, we provide guidance on registering sole proprietorships that have been reported on taxes but have not yet been registered with the state.

No. Businesses must be “In Good Standing” at the time of form submission. Businesses with a “Delinquent” or “Non-compliant” status will not be considered for the grant program.

No. Only for-profit businesses are eligible.

No. Only business owners may apply for this grant program.

Yes. The program is available statewide to small businesses in Colorado that meet all the program’s Eligibility Criteria, regardless of their status and/or interaction with CEDS Finance.

Yes. Having received previous grants from CEDS Finance does not disqualify applicants.

Yes. This grant program does not require citizenship or legal status.

Yes. This grant program does not require Applicants to have a SSN. However, please note that in order to disburse grant funds to Awardees, CEDS Finance will request W9 forms.

Yes. All startups and existing underserved small businesses are eligible to apply as long as the business is reported on 2022 or 2023 tax returns.

No. The grant is restricted to $5,000 per individual and by business. For example, if a business owner owns three businesses, he/she/they are only eligible for one grant.

No. There is no minimum number of full-time equivalent employees required to apply to the grant program.

Yes. To ensure we support small businesses effectively, grants will be awarded to businesses that did not exceed $2 million in gross annual revenues in the previous fiscal year. Importantly, there’s no minimum revenue requirement to apply, making this opportunity accessible to a wide range of small businesses seeking support.

Applicants who collaborate with ride-sharing services such as Uber or Lyft will be eligible as long as they operate through a business registered with the Secretary of State of Colorado.

Businesses that operate in the following industries are ineligible:

- Lending;

- Gambling;

- Federally illegal business;

- Oil and gas;

- Anything involving a prurient sexual nature;

- Political or lobbying activities;

- Indoctrinating religion or religious beliefs;

- Exclusive membership;

- Speculative businesses;

- Investments or grant packaging; and/or

- Money services.

If your business does not have a majority owner, select an owner representative of the group to apply. In the open comment section, let us know there is no majority owner. If you do seem to qualify for one of our grants, we will follow up to verify your overall eligibility. We may also request income information from other owners representing at least 51% of the business.

Grant Submission

Visit our website on May 1, 2024 for the application link or check your email for a direct link sent that morning.

Yes, duplicate grant applications will automatically be filtered and eliminated.

Have questions or need assistance with your application? We’re here to help every step of the way, through webinars or office hours. CEDS Finance is ready to assist applicants in person, ensuring accessible and comprehensive support for all interested parties.

Call us at 720-257-9166 on our dedicated grants hotline. This will be staffed Monday-Friday, 8:30 AM – 5:00 PM until the grant has closed.

Email us at grants@cedsfinance.org. This email will be carefully monitored through the end of the grant and you should expect to receive a response in one business day or less.

You can view the recording of the Small Business Grants Info Session webinar by clicking here. Starting at minute 19:00, we provide a detailed walkthrough of the application process.

Visit our offices during these hours:

Application Preparation Support

● Friday, April 26th, 8:30 AM-5:00 PM

● Monday, April 29th, 8:30 AM-5:00 PM

● Tuesday, April 30th, 8:30 AM-5:00 PM

Application Submission Support

● Wednesday, May 1st, 8:30 AM-5:00 PM (application opens at 10:00 AM)

● Thursday, May 2nd, 8:30 AM-5:00 PM

● Friday, May 3rd, 8:30 AM-5:00 PM

We are located at 10660 E Colfax Ave, Suite B (back parking lot).

Need help ensuring you are registered and in Good Standing with the state of Colorado?

You can watch a recording of our webinar here, which covers verifying the Good Standing status of registered businesses and correcting it if necessary. Additionally, we provide guidance on registering sole proprietorships that have been reported on taxes but have not yet been registered with the state.

Individual support on verifying your registration status:

● Visit our offices on Wednesday, April 24th from 12:30 PM – 5:00 PM for support on a first-come, first-served basis

● Reserve an individual appointment for support.

Appointments are limited. Most appointments are available only through Google Meet. Late appointments will not be rescheduled.

Applicants must submit the following documents:

- 2022 or 2023 Personal Tax Returns including:

- Form 1040 + Schedule C;

- or Form 1040 + K-1

To learn more about these required forms, please visit the following link.

Even though CEDS Finance does not require a copy of a Certificate of Good Standing, we will verify the business’s status with the Secretary of State of Colorado.

You have the option to attach these documents directly to your online grant application. Alternatively, if you prefer to submit physical copies, they must be received by:

- Deadline: Friday, May 3rd at 5:00 PM

- Location: CEDS Finance, 10660 E Colfax Ave Suite B, Aurora, CO 80010

- Office Hours: Monday to Friday, 9:00 AM to 5:00 PM

You can prepare by gathering your 2022 or 2023 tax return, including your IRS Form 1040 and Schedule C or K-1. These documents will be necessary and are required as part of program eligibility. The application will not be opened until May 1st at 10:00 AM, so you will not be able to start the application until then.

To learn more about these required forms, please visit the following link.

No. We will ONLY accept tax docs starting at 10 AM on May 1st. Individual staff members cannot take them early.

Yes, as long as you include Form 1040, Schedule C and/or Schedule K-1.

No, only 2022 or 2023 tax returns will be accepted at this time.

No documentation will be accepted after May 3, 2024 at 5:00 PM

CEDS Finance will automatically eliminate or discard incomplete applications or applications without required tax forms.

Once you’ve completed the application process, you’ll be directed to a page confirming that your application has been submitted. Additionally, please note that you’ll receive a confirmation email for your grant submission. However, it may take up to 24 hours for this email to appear in your inbox.

Verification Process

Awardees will receive their funds via ACH.

You must submit a W-9, a copy of your unexpired Identification, and your most recent bank statement or a voided check (preprinted with the account holder’s name; no temporary checks will be accepted) if you prefer to receive your funds via ACH.

Beginning May 22, 2024, CEDS Finance will send all Awardees a disbursement form and a list of required documents. Awardees will sign the disbursement form, attach all required documents, and send it to CEDS Finance via DocuSign.

Yes. You will have up to 10 days to submit all required documents or risk forfeiture of funds. If the Awardee is unable to submit the required documents by May 31st, 2024, CEDS Finance will invalidate the award (reassigning it to the next eligible Awardee).

Grant Award

We expect to notify Awardees via email by June 3, 2024.

CEDS Finance expects to disburse grant funds to Awardees approximately in the first week of June 2024.

This grant may be taxable depending on the Awardees tax situation. CEDS Finance will provide the Awardee with an IRS Form 1099 in early 2025 as a record of income.

CEDS Finance will disburse funds through ACH. Alternative options may be available on a case-by-case basis.

Due to the expected high volume of Applicants, feedback will not be provided at this time. However, all applicants will be notified of their grant application status, whether they did or did NOT receive a grant.